To help you make sense of the recent interest rate hikes by the Bank of Canada, our blog this week is focused on what impact these monetary policies have on the current housing market.

Before proceeding with the blog, it’s important to note that the ultimate goal of increasing interest rates is to encourage people to spend less and save more. Canada and to a greater extent the rest of the world, is seeing rapid price increases due to the after effects of the Covid-19 lockdowns and the current war in Ukraine. The consequences that come with letting inflation run rampant are significantly more detrimental than increasing interest rates. Governments generally don’t like it when the cost of living increases faster than wages. Unfortunately for homeowners and potential homebuyers, interest rate hikes come with unintended consequences to the current housing market.

To help you navigate today’s rising interest rate environment, here are a few points to consider;

Interest rate hikes have an inverse relationship to how much lenders are willing to give you. As a rule of thumb, for every 0.5% increase in the qualifying rate (5.25% stress rate or the contract rate plus 2% - whichever is higher), potential new home owners can expect their purchasing power to drop by about 5%(approximately). So, if you were in the market for a $500,000 home and qualifying went up by 0.5%, the purchasing power for your future residence would drop to $475,000 ($500,000 * [100% -5%]). The image below shows how the purchasing power of a $500,000 home drops as the qualifying rate rises.

.avif)

Additionally, when looking at the current state of the housing market, It is important to factor in the effects of Buyer Psychology in this rising interest rate environment. Aspiring homeowners with mortgage pre-approvals at lower-than-current rates are motivated to buy before their rate guarantee expires and Buyers who expect higher interest rates in the future may choose to buy now while their carrying costs are lower.

If rates go up significantly, some people may not be able to afford their homes anymore. Thankfully, the federal government introduced a mortgage stress test a few years ago to ensure that homeowners would still be able to afford their home seven at much higher interest rates. As of June 1st 2021 the minimum qualifying rate is based on either the benchmark rate of 5.25% or the rate offered by your lender plus 2% - whichever is higher.

Unfortunately, if your mortgage term is coming to an end and the Bank of Canada increases rates greater than the 2% threshold (which they have), you might still find yourself in a situation where you are not being able to afford your mortgage once it renews at a higher rate.

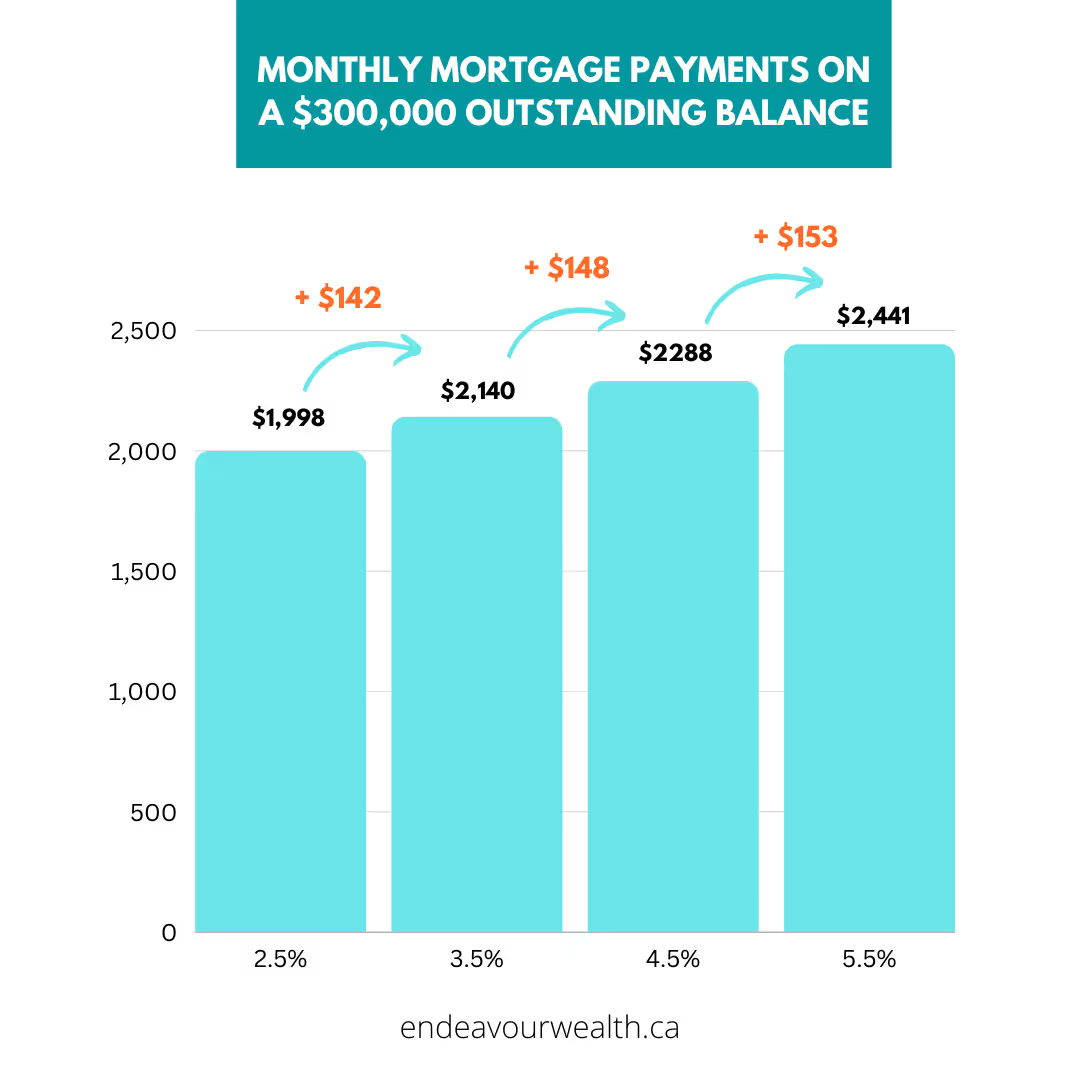

So you might be wondering, by how much are your monthly payments likely to increase for everyone-percentage-point increase in mortgage rates? The chart below outlines what your monthly payments will be given a $300,000 outstanding balance with 15years left on the mortgage.

While we are still theoretically in a sellers’ market, things are starting to slow down. A year ago, submitting an offer over asking price was the standard. Today, submitting an offer at asking is reasonable. As much as increasing interest rates are reducing the purchasing power of home shoppers, the conditions are starting to look a little more favorable.

This is partly due to the fact that increasing interest rates mean a lot of Canadians want to get out of their mortgages. This in turn results in an increased supply of homes in the real estate market, and economics 101 tells us that when supply increases and demand stays constant, prices are likely to drop.

It's important to note that we are not in the game of predicting future interest rates, but having an understanding of the current monetary landscape can allow you the opportunity to save thousands of dollars in interest. When making any financial decision around your mortgage, it is important to consult with your Investments Advisor on what works best for you and your family.

-Kondwelani Kalinda, Licensed Assistant

Kondwelani Kalinda is a Licensed Assistant at Endeavour Wealth Management with iA Private Wealth, an award-winning office as recognized by the Carson Group. Together with his partners he provides comprehensive wealth management planning for business owners, professionals and individual families.

This information has been prepared by Kondwelani Kalinda who is a Financial Planning Assistant for iA Private Wealth and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Investment Advisor can open accounts only in the provinces in which they are registered.

If you felt a little uneasy at times this year, you weren't alone. It was a year characterized by mixed signals, economic data that defied expectation

December 29, 2025

Imagine you’re starting a road trip alone. You’ve got a full tank of gas, the music is on, the destination is… well, undefined. You could head toward

December 22, 2025

One of the core promises of index investing is diversification: own the market, spread your risk, and avoid reliance on any single company or sector.

December 15, 2025

Download your free guide to financial freedom.

Download your free guide to learn how you can protect your retirement savings with a Personal Pension Plan.

Download your free guide to help ensure you don’t run out of money.

Download your free guide to learn how to ensure your portfolio and plan stay on track.